Why not sell your business and pay ZERO INCOME TAX?

When a US business is sold, it is typically done through a sale of assets, which results in high income taxes being owed by you, the seller.

HOWEVER, when all available tax strategies are included in the negotiation process, a combination of a share sale and the PROVEN SOLUTIONS can result in ZERO INCOME TAX which allows you to keep more of your wealth in your hands and still attract a great buyer.

Detailed analysis: Sale of a C-Corp and Sale of a LLC

Sale of Assets For C-Corp – hypothetical example

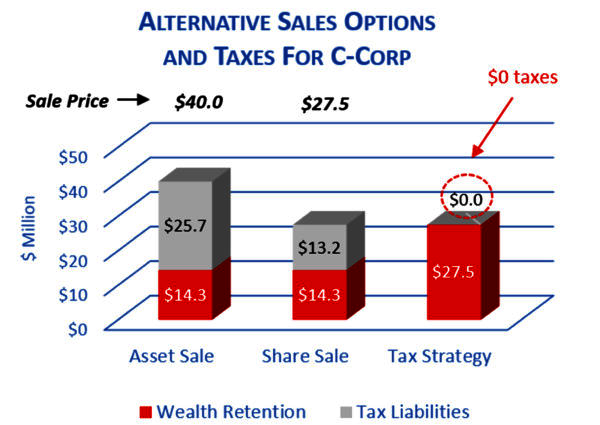

A business that is sold with a value of $40.0 million in assets with an asset tax basis of $2.0 million results in a taxable gain in the C-Corp of $38.0 million.

After paying income tax in the C-Corp on this gain and paying out a dividend to you, the shareholder, the total income taxes paid is approximately $25.7 million.

Net cash in your pocket is $14.3 million.

Sale of Shares For C-Corp

To receive the same $14.3 million in after-tax proceeds for you, the shareholder, a sale of shares scenario requires that a purchaser be found that will pay $27.5 million for your shares.

However, you are still paying $13.2 million in income tax to arrive at net cash in your pocket of $14.3 million.

With planning, you can sell your C-Corp shares for $27.5 million and keep every penny.

* Assumes income tax rates as proposed by the Biden Administration

Why a Share Sale

Question … Why would a purchaser buy the shares when generally, the purchaser would want to buy the assets to benefit from higher future depreciation to save future taxes?

Answer … The purchaser is getting the benefit of income tax deductions upfront by paying $12.5 million less for the shares.

Both of the seller and purchaser win and you double your retained wealth as a result of the sale. Why pay 50% income tax when you don’t have to?

LOW TAX or FULLY TAX-FREE solutions to selling US businesses